capital gains tax proposal reddit

In 2022 if you earn less than 41675 you will not have to pay capital gains tax. Bidens fiscal 2023 budget request released Monday would impose a 20 minimum tax on the unrealized capital gains for households worth at least 100 million.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

. In other words they want to tax anybody that gain over 1000000 37 in which it will help prevent economy disparities among Americans preventing a market crash. For Taxpayers other than corporations the overpayment and underpayment rate is the federal short-term rate plus 3. Biden recently announced they are proposing raising the capital gains to 396 to those who make over 1 million.

But theres a legal way to delay if. President Joe Biden will propose almost doubling the capital gains tax rate for wealthy individuals to 396 to help pay for a raft of social spending that. Depending on your income rates for the capital gains tax are 0 15 or 20.

New Zealand S New 39pc Capital Gains Tax It S Pretty Harsh R Newzealand. Id like to sell the rest of our stock soon but am worried about the potential consequences especially since if I needed to I could sell some. 0700 AM ET 04292021.

Figures like Tesla CEO Elon Musk and Amazon. Capital Gains tax proposal buying opportunity. Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the sum total of their unrealized gains.

Capital gains tax proposal reddit Friday May 27 2022 Five 5 percent for individual overpayments refunds Five 5 percent for individual underpayments balance due Under the Internal Revenue Code the rate of interest is. On the tax front the biggest surprise in bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to april 2021. Not to get political in a crypto sub but this will never get the 50 votes to.

Long-term capital gains are taxed between zero to 20 depending on your income bracket but the average rate is 15. The new Billionaire Income Tax is being written by Senate Finance Committee Chairman Ron Wyden Democrat from Oregon with input from the US. Things are heating up.

Press J to jump to the feed. Press question mark to learn the rest of the keyboard shortcuts. 23 hours capital gains and capital pains in the house tax proposal the wall street journal.

President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US. Our tax filings is normally just our salaries. 225 Gorham Road South Portland Maine Paula Findlay Ironman Cardiff Relegated Ole Timeless Wisdom Deck Upgrade Best Defenders In Nba 2021 Anioł Z.

Read this on the new capital gains tax proposal on page 61. Crypto capital gains tax reddit. Long-Term Capital Gains Tax Rates Long-term capital gains and qualified dividends would be taxed at ordinary rates with 37 percent generally being the highest rate 408 percent including the net investment income tax.

Five 5 percent for individual overpayments refunds Five 5 percent for individual underpayments balance due Under the Internal Revenue Code the rate of interest is determined on a quarterly basis. I see that theyre saying now that anyone making over a million would see capital gains taxes go up to about 40 and then state taxes on top of that. These superwealthy Americans would fall subject to the usual 238 capital gains tax on the increased value of unsold assets like stocks and bonds.

On the retroactive capital gains tax hike. I dont think make a lot of sense. Im wondering if theres any chance this will affect the 2021 tax year.

Households worth more than 100 million as part of his budget proposal. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. If you make more than that you will have to pay capital gains tax based on the 15 rate.

This might also include the ongoing Medicare surcharge. The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax. President Joe Bidens proposal to nearly double the capital gains tax rate to 396 is unnerving investors.

This proposal would be effective for tax years beginning after December 31 2022. Short-term capital gains are taxed as ordinary income meaning the rate could. However its likely to face bipartisan resistance for the precedent it sets.

But if you earn more than 459750 the capital gains tax will increase to 20. But profits from sales or gifts of assets during life would still be taxed at 238 percent. Thats why i do so.

The proposal would increase the maximum capital gain and qualified dividend rate from 20 to 25 with an effective date of September 13 2021 the date of introduction of the proposal. Its a proposal that could curry favor with progressives. Long-term capital gains are gains from investments that are held for more than 12 months.

53 rows Under Bidens proposal for capital gains the US. Combining Bidens proposed capital gains tax with the existing estate tax law which says that if you die with over 117 million in assets that amount is taxed once at a 40 rate some wealthy. Biden has proposed taxing capital gains at ordinary income tax rates for taxpayers earning more than 1 million annually.

Amcstock Read this on the new capital gains tax proposal on page 61. Manchin said the idea is a tough.

Housing In Equity And The Spatial Dynamics Of Homeownership In France A Research Agenda Le Goix 2021 Tijdschrift Voor Economische En Sociale Geografie Wiley Online Library

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Sustainability Free Full Text Fortresses As Specific Areas Of Urban Greenery Defining The Uniqueness Of The Urban Cultural Landscape Warsaw Fortress A Case Study Html

A Landlord S Guide To 2022 Landlord Insider

406 Startup Failure Post Mortems

A Better Way To Tax The Rich Raise The Capital Gains Tax And Treat Investment Earnings Like Ordinary Income R Politics

Everything You Need To Know About Bitcoin Taxes And Capital Gains R Bitcoin

There Are Potentially Huge Us Tax And Reporting Implications If El Salvador Makes Bitcoin Legal Tender R Bitcoin

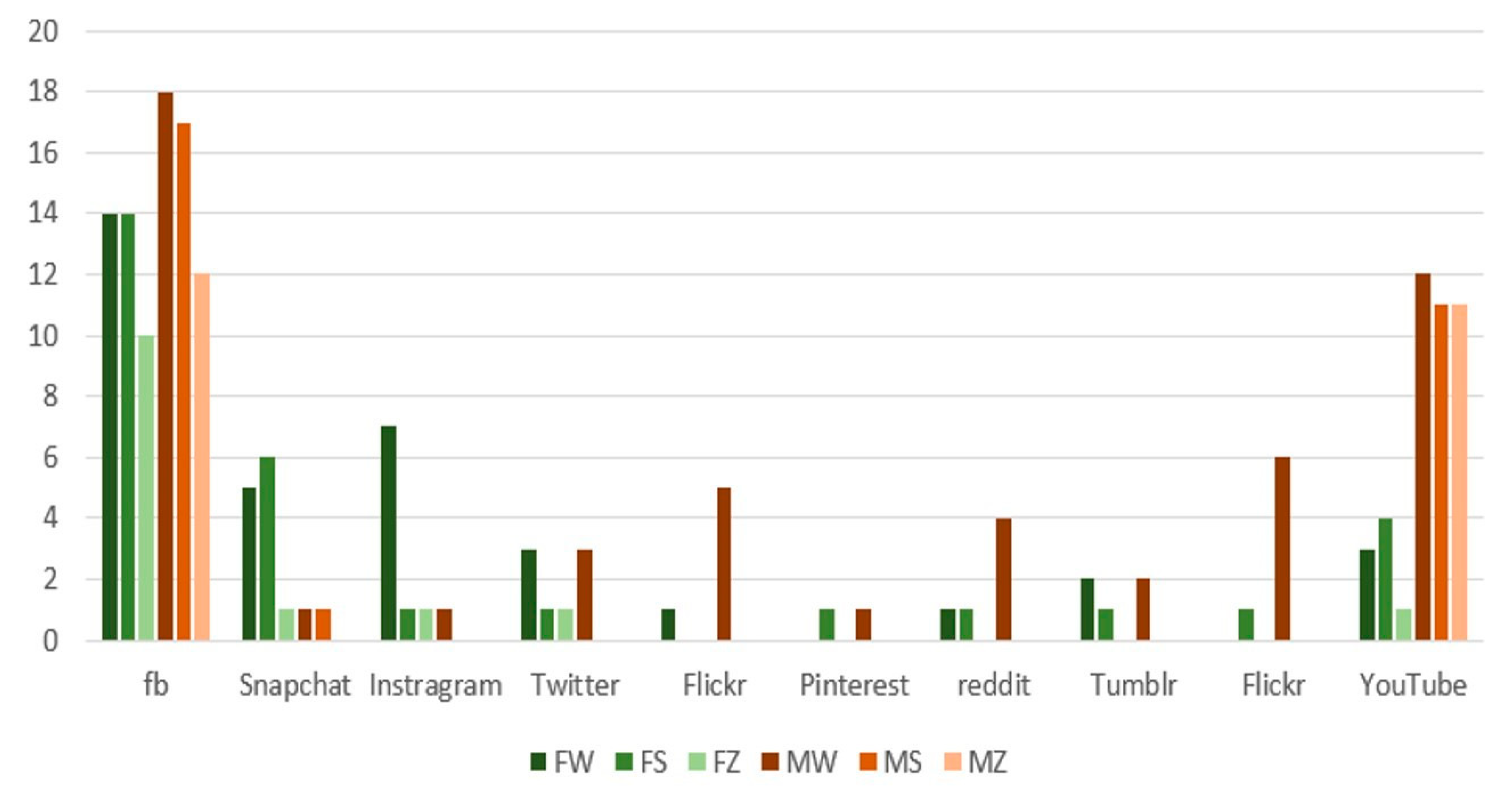

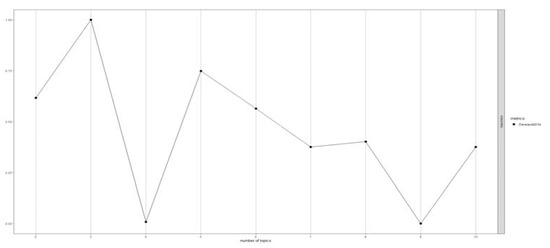

Sustainability Free Full Text Topic Modeling Analysis Of Social Enterprises Twitter Evidence Html

Tax Reform For Progressivity A Pragmatic Approach

On A Tear Ci Financial Scoops Up U S Rias At Breathtaking Pace Investmentnews

Higher Tax Rates For Billionaires And Corporations Can Still Fund Biden S Agenda

Taxation Of Housing Killing Several Birds With One Stone Bo 2020 Review Of Income And Wealth Wiley Online Library

Higher Tax Rates For Billionaires And Corporations Can Still Fund Biden S Agenda

Reddit Chooses To Leverage Arbitrum S Layer 2 Tech With Community Point Eth Based Tokens Jackofalltechs Com