workers comp filing taxes

Workers compensation benefits are not normally considered taxable income at the state or federal level. Although workers compensation is not taxable you are still required to file a return if the income you earned in addition to your workers compensation meets the IRS filing requirements.

Are Maintenance Payments Taxable Does Maintenance Count As Income The Young Firm

Learn more about workers comp from The Hartford.

. Under this rule workers compensation. The short answer is no under both federal and Pennsylvania. Although most income is taxed at different rates it is generally taxable.

The short answer to this question is no taxes are not normally taken out of workers compensation payments. Taxpayers who meet the requirement to file based upon income and filing. Workers compensation benefits and settlements are fully tax-exempt which means you do not have to pay taxes.

Do you claim workers comp on taxes the answer is no. If you return to work after qualifying for workers compensation payments you continue to receive while assigned to light duties are taxable. The following payments are not taxable.

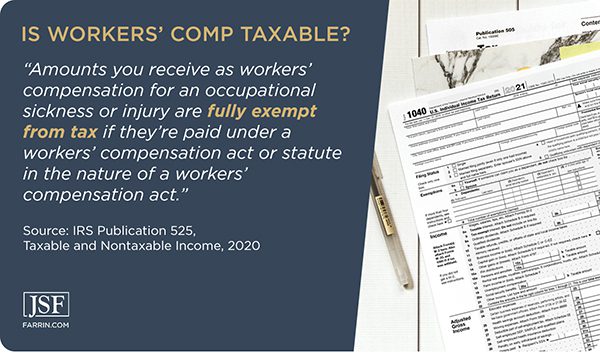

Amounts received as workers compensation for an occupational sickness or injury are fully exempt from tax if paid under a workers compensation act or a statute in the nature of a. While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms. The same holds true for workers comp settlements.

Non-taxable income does not have to be reported to the IRS and workers compensation is specifically mentioned in IRS publication 907. You do not have to report workers comp income on your tax returns. Workers compensation is not taxable income.

If youre out of work. There is typically a one-year to two-year deadline for filing a workers comp. Whether you have received weekly payments or a lump.

Even though the IRS should not be taxing your workers compensation benefits there are still ways it can be technically considered income. Generally workers compensation benefits are not considered income and therefore are not subject to taxes. Report these payments as wages on Line 7 of Form.

The IRS manual reads. However a portion may get taxed if you receive Social Security Disability Insurance SSDI or Supplemental Security Income SSI. To find the correct answer to the.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a. IRS Publication 907 reads as follows. Workers compensation up to the amount you deducted for medical expenses related to the claim should be reported as income.

Under most normal circumstances workers compensation. According to the IRS 2018 publication 525 amounts received from this settlement are exempt from tax when paid under the workers compensation act. Generally you do not pay taxes on your workers comp benefits.

This also applies to the. Workers compensation for an occupational sickness or injury if paid under a workers compensation act. If you received workers comp for the entire year you would have no income to report on your taxes IF its the.

Whether you received wage loss benefits on a weekly basis or a lump sum settlement workers compensation is not taxable. In particular you cannot get some. Most workers compensation forms are available for printing on the IRS Employee Resource Center ERC website at httpercwebirsgov in Workers Compensation articles at.

The lone exception arises when an individual also receives disability benefits. Is workers comp taxable. Workers compensation benefits arent usually taxable at the federal or state level.

No you usually do not need to claim workers comp on your taxes. As with everything in the tax code though there are exceptions to this rule. Workers comp benefits are generally tax-free.

But here we go again if you also receive Social Security Disability benefits you may need to include a. Workers compensation benefits are not taxable on a federal or state level. Workers Compensation Insurance as well known as.

If you didnt deduct medical expenses. Compensation payments made via the Federal Employees Compensation Act FECA are generally not taxed. The answer is no.

Thats because the benefits are considered. However the payments that are made for up to 45 days while the. Workers compensation benefits do have to be reported on a.

With the tax filing deadline quickly approaching many are wondering whether they must pay taxes on their workers comp benefits.

Are The Benefits From Workers Compensation Taxable In Texas D Miller

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

Ohio Workers Compensation Benefits And Income Tax Monast Law Office

Workers Compensation And Taxes James Scott Farrin

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

Montana Workers Compensation Settlements Are They Taxed Bulman Jones Cook Pllc

Are My Workers Comp Benefits Taxable In Massachusetts

Healthcare Travel Taxes For Pas Nps And Allied Workers 6 Things To Know

Do I Have To Pay Taxes On Workers Compensation

Do I Pay Taxes On My Workers Compensation Settlement In Ohio

Workers Compensation And Taxes James Scott Farrin

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A

Are My Vermont Workers Compensation Benefits Taxed

Is Workers Compensation Taxable In Florida Sternberg Forsythe P A

Workers Comp Form 100 Fill And Sign Printable Template Online Us Legal Forms

Is Workers Comp Taxable Workers Comp Taxes

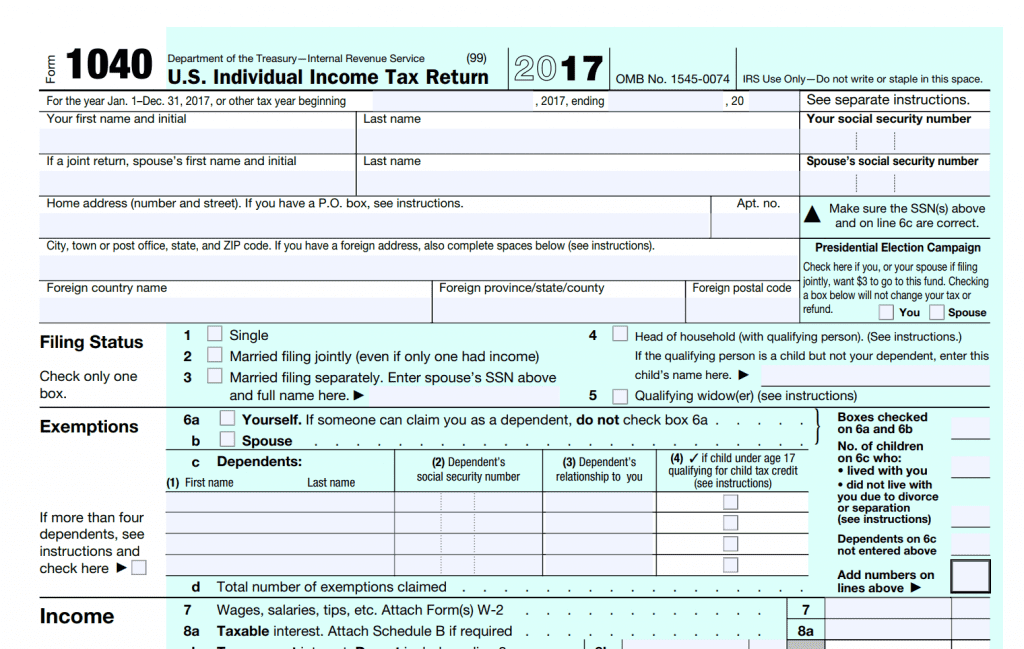

How To Deduct Workers Compensation From Federal Tax Form 1040